On March 27, 2025, The Macao International Carbon Emission Exchange (MEX) , in collaboration with Tsinghua University's Carbon Neutrality Research Institute and the School of Carbon Neutrality and Climate Change at the Hong Kong University of Science and Technology (Guangzhou) Social Hub, released the Asia Voluntary Carbon Market Development Report 2024. The report's data shows that Asia has become the core engine for global carbon credit supply.

Based on the current status and development trajectory of Asia's carbon credit market, this report focuses on the frontier practices of Asian countries in carbon credit market scale, policy dynamics, and high-quality carbon credit mechanisms. Through systematic analysis and in-depth insights, it provides a forward-looking vision for the future evolution and strategic layout of Asia's carbon credit market.

Abstract

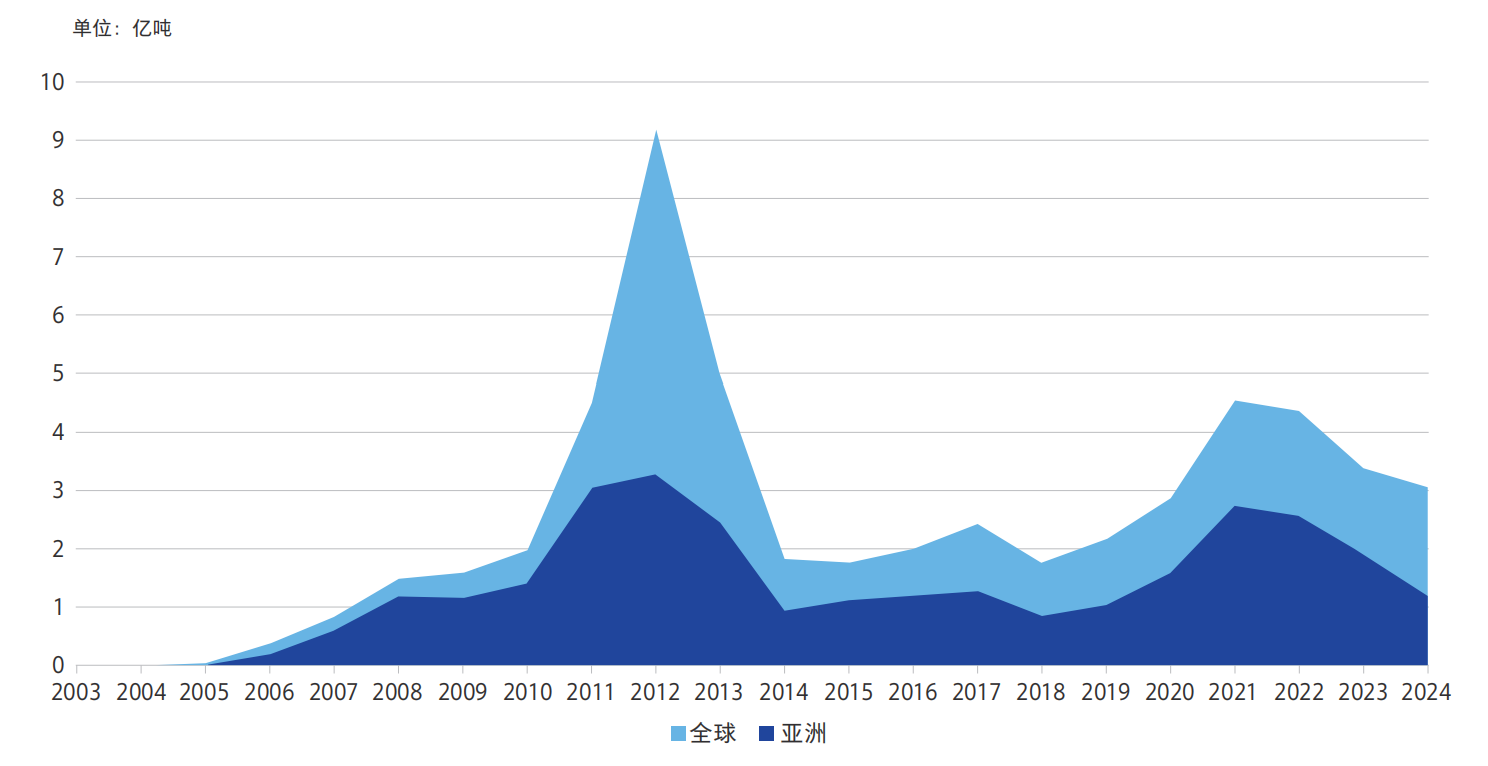

As the core supply region of the global carbon credit market, Asia plays a pivotal role worldwide. By the end of 2024, the cumulative issuance of Asian carbon credits globally reached 2.978 billion tons, accounting for 56.19% of the global total. Among them, China and India dominated market supply, contributing 48.15% and 23.23% of the issuance respectively. Although the Clean Development Mechanism (CDM) is gradually withdrawing from the historical stage—with its issued Asian carbon credits accounting for only 7.8% of the Asian total in 2024—CDM still accounts for more than 65% of Asia's historical issuance.

In terms of international emission reduction mechanisms, the Verified Carbon Standard (VCS) and Gold Standard (GS) are the most active in Asia, with their 2024 Asian carbon credit issuances accounting for 54.6% and 33% of the Asian total respectively, serving as the main sources of emission reduction mechanisms for Asian carbon credit development. In terms of regional distribution, East Asia (50.87%), South Asia (31.31%), and Southeast Asia (12.4%) are concentrated project areas, while Central and West Asia have significant potential for carbon credit project development.

Regarding high-quality carbon credits, as of December 2024, Asian carbon credits with additional benefit labels accounted for only 14.3% of the Asian total, mainly labeled with the Sustainable Development Goals (SDG). Carbon credits labeled under the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) are primarily concentrated in South Asia (50.6%), while Core Carbon Principles (CCP)-labeled credits are mainly issued through the VCS and GS mechanisms.

In 2024, the average price in the voluntary carbon market was approximately $4 per ton. Carbon dioxide removal (CDR) projects demonstrated significant premium due to their permanence, with engineered carbon removal prices reaching as high as $140 per ton—far exceeding other project types. Projects labeled with the Sustainable Development Goals (SDG) carried a $2 per ton premium. Prices of Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA)-labeled credits fluctuated due to compliance demands, while Core Carbon Principles (CCP)-labeled credits commanded a $2–$5 per ton premium due to scarcity. Market preference is increasingly shifting toward high-quality carbon credits, with 57% of enterprises inclined to purchase CDR projects.

In 2024, Asian countries made notable advancements in their domestic carbon credit mechanisms. China continued to refine its National Certified Voluntary Emission Reduction (CCER) mechanism, standardizing project validation and emission reduction accounting to facilitate the entry of more high-quality projects into the market. India established a specialized carbon trading regulatory authority and authorized designated institutions to issue Carbon Credit Certificates (CCC). Japan’s Green Transition Emissions Trading System accepted project registration applications for "other eligible carbon credits" from other countries, including carbon dioxide removal (CDR) credits from carbon capture, utilization and storage (CCUS), bioenergy with carbon capture and storage (BECCS), and direct air capture and storage (DACCS), with a cap of 5% of enterprise emissions for offset use. Countries such as Vietnam, Indonesia, and Malaysia introduced relevant policies to accelerate the establishment of domestic carbon credit markets.

In 2024, Asian countries actively engaged in international cooperation under Article 6 of the Paris Agreement. Japan promoted more carbon emission reduction cooperation projects with other countries through its JCM framework, providing technical and financial support. Singapore signed Article 6 cooperation agreements with countries such as Ghana and Papua New Guinea, allowing enterprises to purchase international carbon credits to fulfill a certain proportion of their carbon tax obligations. Thailand completed its first ITMOs (International Transfer of Mitigation Outcomes) transaction, setting a practical example for regional carbon credit trading. Singapore launched subsidies for Article 6 carbon credit projects and established the Singapore Carbon Market Alliance (SCMA), aiming to help Singaporean enterprises access high-quality international Article 6 carbon credits. The ASEAN Carbon Market Common Framework (ACCF), jointly initiated by the Indonesian Carbon Trade Association, Thailand Carbon Club, Malaysia Carbon Market Association, and Singapore Sustainable Finance Association, is actively promoting the interconnection of regional carbon markets.

Looking ahead, the Asian carbon credit market needs to focus on the following key areas: First, strengthen the construction of high-quality carbon credit standard systems and the certification of additional benefits; second, focus on emerging carbon dioxide removal technologies such as nature-based carbon removal and engineered carbon removal technologies; third, integrate markets through the Article 6 mechanism to optimize the implementation pathways of Nationally Determined Contributions (NDCs); fourth, improve the coordination among carbon taxes, Emissions Trading Systems (ETS), and carbon credit markets, and enhance data tracking capabilities to promote the sustainable development of the Asian carbon credit market.

Popular articles

MEX and Xpansiv Enter Strategic Partnership to Advance Global Environmental Commodities Market Connectivity

MEX and TCMC Forge Strategic Partnership to Connect Key Asian Carbon Markets

TDM "Finance Magazine" Interviews Macao International Carbon Emission Exchange (MEX) to Discuss New Opportunities in Low-Carbon Development

Notice for Membership Recruitment of the Trading Platform of Macao International Carbon Emission Exchange

A group of participants from the "China - Portuguese - speaking Countries Digital Economy Seminar" visited the Macao International Carbon Emission Exchange (MEX)